California to Update Health Care Worker Minimum Wage Requirements

By Georgia Green

Senior Manager

Health Care Consulting Practice, Moss Adams

Original Publish Date: November 5, 2024

Senate Bill (SB) 525, signed by California Governor Gavin Newsom, set into motion a series of deadlines to implement minimum wage payment increases at health care facilities, for both clinical and non-clinical staff and contractors. The bill aims to address the deficit of health care workers following the COVID-19 pandemic.

On May 31, 2024, the Governor signed SB 828, delaying the implementation date to July 1, 2024. Later, on June 29, 2024, SB 159 was signed, further delaying implementation of SB 525 until October 15, 2024 at the earliest.

For details about the minimum wage rates and phase-in schedule originally proposed under SB 525, reference our prior article, New California Health Care Worker Minimum Wage Requirements in 2024.

Types of Workers Covered by the Law

The definition of workers covered by the health care minimum wage law hasn’t changed from the original SB 525 issuance. Workers are included, whether they’re providing health care services directly to patients or supporting the health care workers or facility—and include both employed and contracted staff.

Some examples of covered workers include:

- Certified nursing assistants

- Technicians

- Patient aides

- Food service

- Housekeeping

- Medical coders and billers

- Schedulers

- Laundry workers

Covered Health Care Employers

Employers included in the health care worker minimum wage requirements must provide notice to their employees when the law takes effect. The following types of facilities are required to comply with the minimum wage law unless an exception or waiver applies.

Hospitals and Health Systems

This includes facilities or work sites which are part of integrated health care delivery systems, as well as licensed general acute care hospitals, acute psychiatric hospitals, and psychiatric health facilities.

Residential Care Settings

Residential care settings include the following:

- Licensed skilled nursing facilities (SNFs) that are part of integrated health care delivery systems

- Residential care facilities that are affiliated with acute care providers or controlled, owned, or operated by general acute care hospitals or acute psychiatric hospitals or the parent entities of the aforementioned hospital types

- Licensed home health care agencies

Other Covered Facilities

Other covered facilities include physician groups with 25 or more physicians, county mental health facilities or correctional facilities providing health care services, and mental health rehabilitation centers.

This also covers outpatient clinics, which includes:

- Dialysis clinics, psychology clinics, Medicare certified surgical or ambulatory surgical centers, urgent cares, rehabilitation centers, and alternative birth centers

- Clinics operated by city, county, state, or University of California hospital and teaching clinics

- Primary care clinics, which includes not-for-profit clinics proving health care, rural health clinics that aren’t license-exempt, as well as community and intermittent clinics

Hospitals Can Verify Inclusion

To verify whether a hospital or health system is included due to having 10,000 or more full-time employees, the Department of Health Care Access and Information (HCAI) has provided a list.

HCAI also provided a list of covered safety net hospitals.

Timing of Implementation

SB 159, the most recent iteration of SB 525, will come into effect when the California Department of Finance notifies the Legislature that its cash receipts for the period July 1–September 30, 2024, are at least 3% higher than projected at the time of the 2024 Budget Act enactment. If this is the case, the minimum wage increase would become effective on October 15, 2024.

SB 159 could also come into effect when the Department of Health Care Services (DHCS) notifies the Legislature that the data retrieval to implement an increase to hospital Quality Assurance Fee (QAF) revenues has been initiated to begin on January 1, 2025.

This data retrieval initiation would cause the health care worker minimum wage increase to occur on January 1, 2025, or 15 days after the date of the DHCS notification. The earliest potential date of this notification is October 1, 2024, which would activate the minimum wage requirements on October 16, 2024.

Given these timelines, the Department of Industrial Relations is recommending that applicable health care providers implement the new wages as early as October 15, 2024.

Waiver Program

Covered employers can apply for consecutive annual waivers of the minimum wage requirement until July 1, 2032. Each waiver delays the implementation of increased minimum wages for one year. Employers that receive a waiver must also post a copy of the waiver and notify their employees.

To be issued a waiver, the health care facility must provide the covered health care facility’s and any parent or affiliated company’s:

- Most recent audited financial statement

- Year to date internally prepared financial statement

- Forecasting with an attestation from an independent CPA to show that raising the minimum wage in compliance with this standard would jeopardize the facility’s positive cash flow

- Calculations demonstrating that the covered health care facility and its parent company have less than 45 days cash on hand and a ratio of current assets to current liability of one or less

The health care facility must also provide a signed declaration by the health care facility’s executives validating that all submitted documents are true and correct.

The waiver application must have been submitted via email by September 20, 2024, for the initial year.

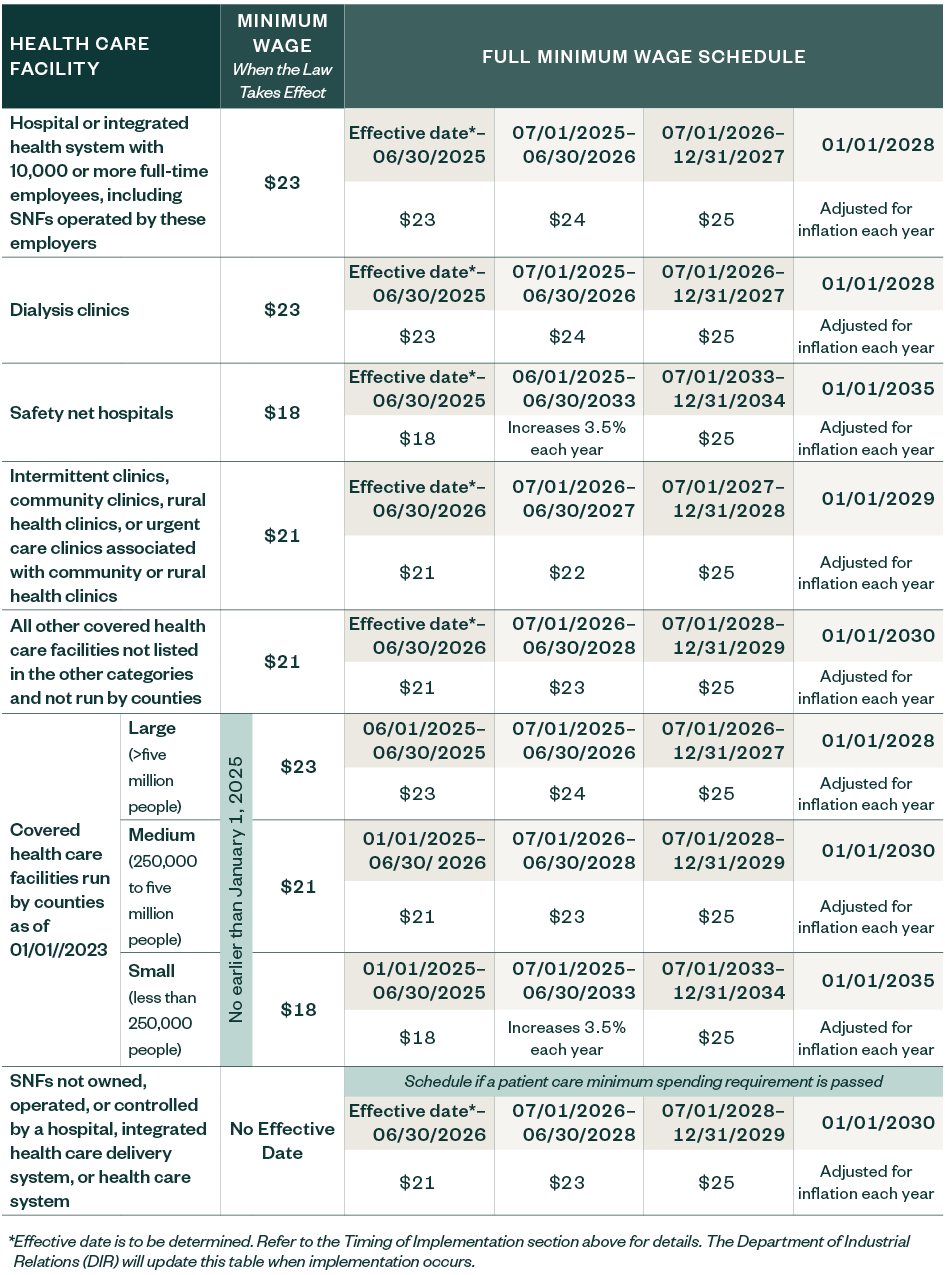

Minimum Wage by Type of Health Care Facility Schedule

The table below indicates when the minimum wage increases will take place based on the type of health care facility.

We’re Here to Help

Whether you’re a covered employer entity or not, the health care minimum wage law may have a profound effect on your labor cost and financial position, due to the increased wages offered by competitors in your market.

If you’d like assistance in evaluating and mitigating the impact of SB 525 on your organization, including financial modeling, compliance support, or waiver applications, contact your Moss Adams professional.

Additional Resources