Prepare for Provider Relief Fund Reporting and Single Audit Requirements

By Aparna Venkateswaran, CPA

Strategy Manager Consulting Services, Moss Adams Health Care Practice

By Georgia Green, MS, CHFP

Strategy Manager Consulting Services, Moss Adams Health Care Practice

Original Publish Date: September 9, 2020

Editor's note: Please register to attend the complimentary webinar on this topic at this link: https://www.mossadams.com/events/2020/september/provider-relief-fund-reporting-single-audit-rqmt

The Provider Relief Fund, authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, has been distributed in various tranches—including the General and Targeted Distributions—since April 10, 2020.

Each distribution has a corresponding set of terms and conditions. Information about the funds has been continuously updated by the Department of Health and Human Services (HHS) within the frequently asked questions (FAQs) web page.

Background

Initially, the terms and conditions and FAQs indicated any entities receiving more than $150,000 in total funds under the CARES Act would be required to file a quarterly report detailing how the funds had been expended beginning July 10, 2020.

Changes

In June, HHS released a FAQ which communicated that recipients wouldn’t need to submit a report by the July 10 deadline.

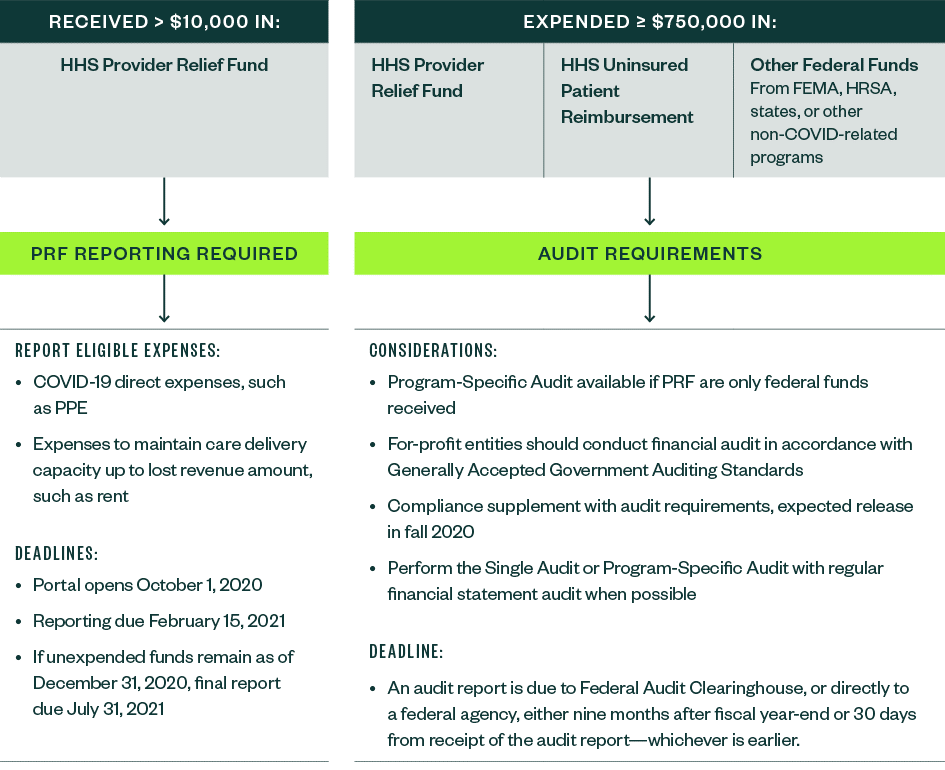

In the quietly-announced July 20, 2020, notice General and Targeted Distribution Post-Payment Notice of Reporting Requirements, HHS noted a dollar threshold of $10,000 would be subject to reporting requirements and clarified the reporting timeline. The detailed reporting specifications are forthcoming.

Timeline

The reporting system or portal is expected to become available on October 1, 2020.

Per current HHS guidance, recipients must submit a report of all their expenditures through December 31, 2020, within 45 days after the end of the calendar year on February 15, 2021. Those recipients who have expended all the Provider Relief Funds prior to December 31, 2020, may submit a single final report any time after the portal is available.

If recipients have unexpended funds on December 31, 2020, they will have until July 31, 2021, to submit a second, final report.

Although prior FAQs had stated that funds can be used “until the conclusion of the pandemic,” the reporting deadline of July 31, 2021, establishes a firmer end-post for recipients who continue to be impacted by COVID-19.

Single Audit Requirement

Not-for-profit, governmental entities, and tribes with reported annual total federal expenditures equal to or above $750,000 are subject to Single Audit requirements which have been adopted by HHS in 45 CFR Part 75, Subpart F.

Awards originating from all federal agencies should also be included in the determination of whether the threshold is met—for example, the COVID-19 Telehealth Program from the Federal Communications Commission (FCC), federal grants sub-awarded by state agencies, and any federal awards unrelated to COVID-19.

On July 22, 2020, HHS clarified that Provider Relief Fund payments and Uninsured Testing and Treatment reimbursement payments must be included in determining whether a recipient organization, other than a commercial, for-profit organization, is required to have a Single Audit.

Additionally, HHS stated for-profit organizations that receive $750,000 or more in annual federal awards have the following two options:

- Financial audit conducted in accordance with Generally Accepted Government Auditing Standards (GAGAS) described in 45 CFR 75.216

- Single Audit in conformance with the requirements under 45 CFR 75, Subpart F

The determination is based on the organization’s fiscal year.

Strategic Considerations

Organizations should strategically evaluate the eligible uses of funding from each source in order to optimize the funding opportunity and should ensure the expenses and lost revenue are captured accurately to maintain compliance with the Provider Relief Fund terms and conditions.

Documentation

Organizations should consider tracking all COVID-19-related funds received and expended through a new set of general ledger accounts or cost centers with corresponding documented internal guidelines and protocols.

The Provider Relief Fund terms and conditions contain requirements that organizations will need to comply with. Now is the time to develop a system of document retention to support decisions, calculations, and processes related to the tracking of funds received and expended in addition to lost revenue. Maintaining the documentation will assist with preparation for future reporting and audit requirements when additional guidance is released.

Master Tracker

Documentation of a COVID-19 funding in a master tracker is critical in order to ensure:

- There is no duplication of expenditures, expenses or losses weren’t reimbursed from other sources, and other sources weren’t obligated to reimburse.

- Funds are used only for eligible purposes.

- Lost revenue is calculated consistently each month.

Expenditures can’t be duplicated with other federal programs, such as the Paycheck Protection Program (PPP) or Federal Emergency Management Agency (FEMA) public assistance.

There isn’t a prescribed format or methodology to track these funds. The key will be to track them in a consistent manner throughout the duration of the award. Your advisors can work with you to develop a comprehensive master tracker tool or review your existing tool.

Board Approval

Larger health care organizations should consider obtaining board approval of a COVID-19 funding and use plan and record it in meeting minutes. The board’s approval of the funding plan is a key part of the organization’s monitoring and control system and establishes broad oversight of the process. This will be helpful when organizations are preparing for related reporting or an audit related to these funds.

Common Concerns

The Provider Relief Fund is to be used for health care related expenses and lost revenues attributable to COVID-19. Organizations often struggle with the concept of lost revenue.

Although there is some flexibility in calculating lost revenue, HHS noted recipients could use any reasonable method. The methodology should be documented and applied consistently. Examples provided by HHS include comparing the 2020 budget-to-actual or the 2019-to-2020 actual.

Recipients can use the funds to cover any costs the lost revenue would have otherwise covered to maintain health care delivery capacity. These costs don’t have to be specific to providing care for possible or actual COVID-19 patients. They include costs that are necessary for an organization to maintain operations such as:

- Rent or mortgage

- Employee or contractor payroll

- Employee health insurance

- Medical record systems

- Equipment lease fees

In addition to expenses that maintain health care delivery capacity, an organization may use the funding as needed for incremental expenditures that are “attributable to coronavirus and were used to prevent, prepare for, and respond to coronavirus.”

This may include items such as personal protective equipment, testing equipment, and staff trainings, as well as the following examples:

- Retrofitting portions of a facility for expanded ICU capacity

- Creating health screening checkpoints

- Developing emergency operation centers

Organizations should also be aware of the Provider Relief Fund terms and conditions. Some limits may apply to certain expenses—for example, the terms and conditions include an annual salary rate cap of $197,300, or $16,441.97 per month. Organizations may pay a higher rate to their employees and contractors using other funding, but can only use the Provider Relief Fund up to this threshold.

Provider Relief Fund distributions should be reported as taxable income as applicable.

Audit Timing

When possible, the Single or Program-Specific Audit—for those entities that are required to or opt to choose these types of audits—should be conducted in parallel with an organization’s regular financial statement audit. HHS has communicated they expect to release additional guidance on the compliance requirements as part of an addendum to the 2020 Compliance Supplement sometime during the fall of 2020.

For-profit organizations that elect to have a financial audit of the Provider Relief Fund conducted in accordance with GAGAS should also consider the timing of the audit. While the financial audit of the program in accordance with GAGAS is different in scope from a Single Audit or Program-Specific Audit, for-profit organizations will still need to demonstrate compliance with the program requirements of the Provider Relief Fund. The release of the addendum to the 2020 Compliance Supplement may impact audit completion deadlines.

Organizations will have nine months from the fiscal year end or 30 days from receipt of the audit report—whichever is earlier—to submit reporting packages.

Organizations should communicate with their auditor frequently about monies received from the CARES Act and other federal grants, from HHS or other federal, state, or local agencies, in order to monitor related audit requirements.

We’re Here to Help

If you have questions about how to optimize federal funding opportunities, document and report your use of the Provider Relief Fund, maintain federal compliance, and prepare for your organization’s financial, Single, or Program-Specific Audit, please reach out to your Moss Adams professional.

Aparna Venkateswaran has been in public accounting since 2004. She provides assurance services primarily to the health care industry, including Knox-Keene-licensed health plans, hospital systems, medical groups, and others. She can be reached at (949) 517-9473 or aparna.venkateswaran@mossadams.com

Georgia Green has worked in the health care industry since 2011. She provides strategic and operational consulting services to health care providers and payers and has extensive experience helping clients integrate value-based care models from start to finish. She can be reached at (916) 503-8251 or georgia.green@mossadams.com.

About Moss Adams LLP

Moss Adams is one of the top 10 accounting and consulting firms in the nation, and the largest public accounting firm headquartered on the West coast. We provide assurance, tax, and consulting insight and expertise to public, private, and not-for-profit health care enterprises, serving more than 3,400 clients across the health care continuum (from large health systems, hospitals, and long-term care organizations to clinics, medical groups, and physician practices). To learn more please visit: www.mossadams.com/healthcare.