New Revenue Recognition Standard Creates Additional Disclosure Requirements for Hospitals

By Joelle Pulver, CPA

Moss Adams

By Kate Jackson, CPA

Moss Adams

Original Publish Date: March 12, 2019

Fundamental changes to how hospitals recognize revenue are beginning to take effect. One of the biggest entails significantly altering the manner in which hospitals and other entities disclose revenue-recognition policies and revenue within financial-statement footnotes.

Background

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Codification® (ASC) Topic 606, Revenue from Contracts with Customers. Topic 606 changes how most organizations are required to recognize revenue under US generally accepted accounting principles (GAAP)—specifically contracts with customers.

Leases, financial instruments, insurance contracts, and nonmonetary exchanges aren’t impacted by the new standard.

Effective Dates

- Public entities, including conduit debt obligors. These entities need to adopt the new standard for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Interim reporting periods include any quarterly or monthly financial information provided publicly—filings on Electronic Municipal Market Access, for example.

- Nonpublic entities. These entities need to adopt the new standard for annual reporting periods beginning after December 15, 2018, and interim reporting periods within annual reporting periods beginning after December 15, 2019.

Beyond the Five-Step Process

After applying the five-step process outlined in ASC Topic 606, the new standard requires hospitals to ensure disclosures provide readers of financial statements with an understanding of the nature, amount, timing and uncertainty of revenue and cash flow.

Most of the information needed to complete the footnote disclosures will be acquired while applying the five-step process.

Key Disclosure Areas

Four of the disclosures outlined in the standard are expected to have the most significant impact on hospitals:

- Disaggregation of revenue

- Contract balances

- Performance obligations

- Significant judgments used in applying guidance

The disclosures and examples discussed below assume organizations are public entities as defined by Topic 606, which includes entities with public debt and conduit debt obligors.

Exceptions for Nonpublic Entities

Throughout the guidance there are exceptions provided for nonpublic entities that significantly reduce the number of required disclosures. These exceptions include the following items:

- Qualitative disclosure only on disaggregated revenue, rather than quantitative—these must still include quantitative disclosure of revenue disaggregated according to timing of transfer of services

- Explanations of significant changes in contract assets and liabilities during the period

- Disclosure around the performance obligations satisfied over time and why the methods used to recognize revenue provide a faithful depiction of the transfer of services

Disaggregation of Revenue

Under the new standard, entities must disaggregate revenue recognized from contracts with customers into categories that depict how economic factors affect the nature, amount, timing, and uncertainty of revenue and cash flows.

In determining how to disaggregate revenue for disclosure, management should benefit from considering three key items:

- Breakouts used internally for operational decision-making

- Categories that may be presented in external publications

- Categories identified while applying the portfolio approach to contracts with similar characteristics

Potential Criteria for Disaggregation

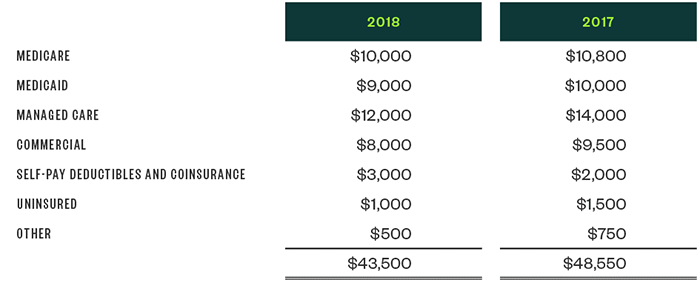

Payer Type

Many hospitals currently disclose revenue by payer type. However, adherence to Topic 606 may require further bifurcation of payer categories to include a breakout between Medicaid and Medicaid managed care. It may also necessitate further disaggregating self-pay between uninsured and copays and deductibles.

Example

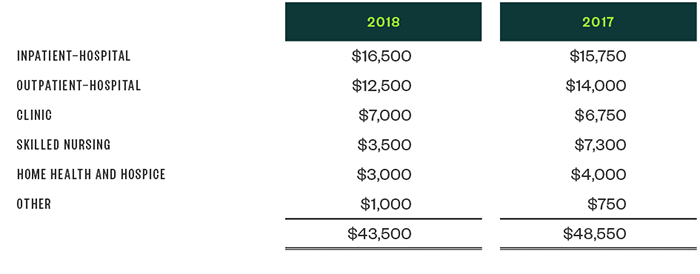

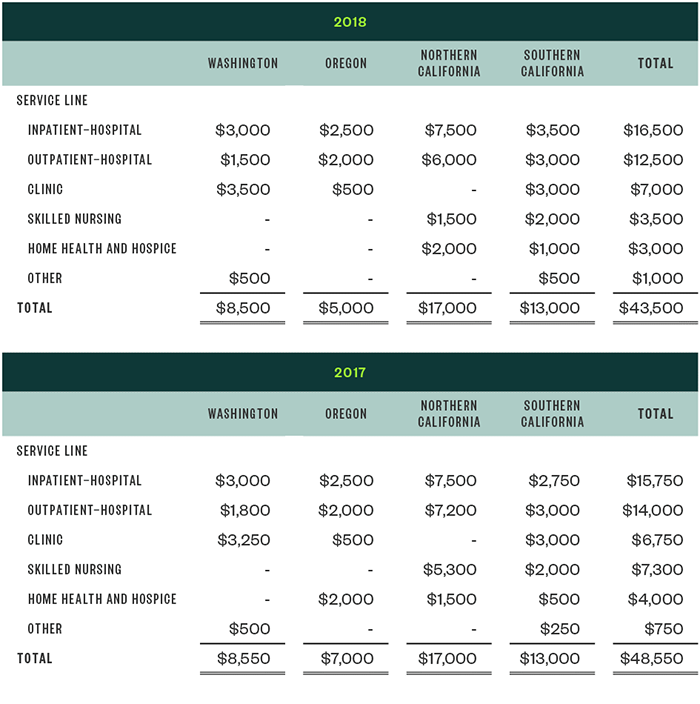

Service Type

Depending on the complexity of a hospital’s operations, management may want to display revenue by line of business, including inpatient, outpatient, clinic, skilled nursing, and home health.

Example

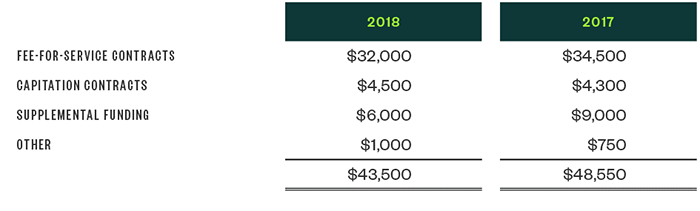

Contract Type

Management should consider providing information on revenue recognized based on capitation contracts as compared to fee-for-service contracts or supplemental funding.

Example

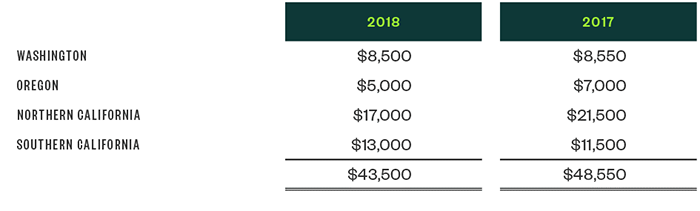

Geography

Hospitals and health systems with geographical diversity across their business may consider disaggregating revenue by region or county.

Example

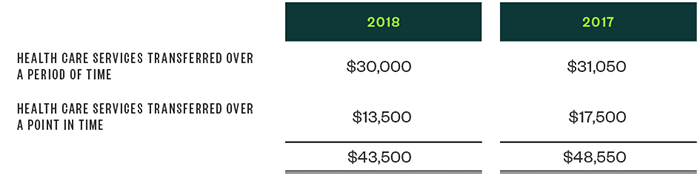

Timing

Management should disclose the amount of revenue recognized at a point in time compared with revenue recognized over a period of time.

For example, services provided in both inpatient and outpatient settings are likely to be considered transferred over a period of time while pharmacy and medical device sales are likely to be classified as point-in-time revenue.

Example

Depending on a hospital’s unique situation and considerations, it’s possible more than one level of disaggregation should be used. Example

Contract Balances

Hospitals will need to disclose the beginning and ending balances of contract assets and liabilities as well as patient accounts receivable if they aren’t otherwise presented on the statement of financial position.

Contract Assets and Liabilities

We don’t expect most hospitals to have contract assets under the new standards; however, a contract asset would be created if a hospital provides goods or services to a customer or patient before an unconditional right to payment is due.

Nonrefundable advanced payments made by a patient to the hospital before goods or services are provided would be considered contract liabilities.

Patient accounts receivable—including billed and unbilled accounts for which the hospital has an unconditional right to payment—would be considered receivables instead of contract assets under the new guidance.

Additional Disclosures

Hospitals must disclose revenue recognized during the reporting period that was previously included in contract liabilities. Any significant changes in the contract assets and liabilities balances during the reporting period should also be disclosed, including qualitative and quantitative information.

Performance Obligations

There are several new required disclosures regarding performance obligations. Under Topic 606, hospitals must include the following information:

Timing

The timing of satisfying performance obligations must be disclosed. This includes services provided at a point in time—such as outpatient procedures or pharmacy sales—and those provided over a period of time—inpatient acute care services, for example. These disclosures should also include the nature of the services to be provided.

Payment Terms

Significant payment terms, including whether consideration is variable or constrained, must be included in the footnotes. For example, hospitals must disclose the following items:

- Third-party-payer agreements that allow payments that differ from established charges and provide payment terms that allow settlement to occur subsequent to the services being provided.

- Whether uninsured patients are offered certain discounts from established rates.

- Revenue from uninsured patients that includes implicit price concessions based on historical collection experience.

Credit Balances

Management must disclose total credit balances that represent refunds owed to patients and third-party payers as of the date of the financial-position statement.

Recognized Revenue

Hospitals need to disclose revenue recognized in the current reporting period for performance obligations satisfied in prior reporting periods, such as changes in implicit price concessions or third-party settlement estimates.

Significant Judgments Used in Applying the Guidance

Hospitals are required to disclose both the judgments and changes in judgment made in applying the new guidance, especially to the following:

- Timing of satisfaction of performance obligations

- Transaction price and amounts allocated to specific performance obligations

Uninsured and Self-Pay Patients

Hospitals will likely want to disclose how they determined explicit and implicit price concessions for uninsured and self-pay patients. This should include any deductibles and coinsurance as well as any revenue constraints.

The determination of implicit price concessions will likely involve many significant judgments, including the application of the portfolio approach and the use of historical collection percentages.

Third-Party Payers

Hospitals should also disclose how they’ve estimated retroactive settlements with third-party payers.

Example Footnote Disclosure

The American Institute of Certified Public Accountants’ Health Care Entities Revenue Recognition Task Force has included an example footnote disclosure in the Revenue Recognition Guide which provides helpful guidance to hospitals implementing the new standards.

Next Steps

The new standard represents a significant change in how hospitals must recognize and disclose revenue from customer contracts. In doing so, the additional disclosures require the accumulation of data and a level of detail that hospitals may not be tracking currently.

This level of reporting combined with the requirement that these disclosures be comparative under the full-retrospective transition method make it imperative management begin documenting significant assumptions and accumulating data immediately.

Joelle Pulver has been in public accounting since 2002. She’s well versed in providing audit services to health plans, integrated health systems, hospitals, senior living facilities, and other health care organizations. She can be reached at (415) 677-8291 or joelle.pulver@mossadams.com.

Katherine Jackson has been in public accounting since 2006. She provides financial statement and single audit services to health care organizations. Kate was the recipient of CalCPA’s 2017 Women to Watch Award in the Emerging Leader category. She can be reached at (916) 503-8197 or katherine.jackson@mossadams.com.

Assurance, tax, and consulting offered through Moss Adams LLP. Investment advisory services offered through Moss Adams Wealth Advisors LLC. Investment banking offered through Moss Adams Capital LLC.